The smart Trick of Frost Pllc That Nobody is Discussing

The smart Trick of Frost Pllc That Nobody is Discussing

Blog Article

Frost Pllc Fundamentals Explained

Table of ContentsAll About Frost PllcThe Frost Pllc PDFsSome Known Details About Frost Pllc The 10-Minute Rule for Frost PllcThe Ultimate Guide To Frost Pllc

Remember that Certified public accountants and auditing companies collaborate with their customers to enhance financial methods and guarantee liability. In this sense, they are accountable to the public along with to their clients. Certified public accountants and bookkeeping firms, as qualified professionals with their very own specialist codes of conduct and policies, are billed with continuing to be independent and objective, no matter of the level of monetary testimonial they provide to the nonprofit customer.

Freedom RequirementAudit company keeps strict self-reliance from the customer to guarantee neutral audit outcomes. Accountancy firm adhere to general accounting principles and regional policies.

The Basic Principles Of Frost Pllc

Bookkeeping firms are subject to basic audit principles with less regulative inspection. If you want to prepare economic declarations without the requirement for an independent audit opinion, you must go for bookkeeping company.

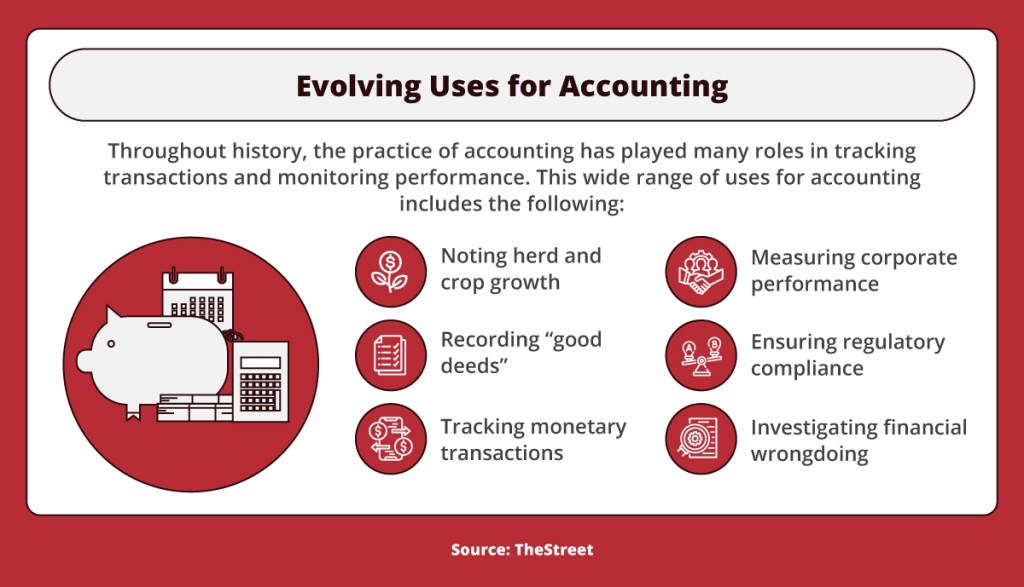

Accounting and bookkeeping are essential in the monetary tasks and records of a business. Accounting professionals are in charge of developing economic documents, observing regular bookkeeping operations for a company's procedures, and making and submitting tax types.

They might concentrate on interior or exterior audits (Frost PLLC). it is important to note that every monetary auditor is an accounting professional, but not every accountant is an economic auditor

Public accountants work in firms offering accountancy solutions, while company CPAs work at business offering something aside from accounting solutions. Company accounting professionals might start with greater pay, though the opportunities for promotion can be leaner. In an accountancy company, on the various other hand, development can be fast and there's constantly the possible to become a supervisor or companion.

Some Ideas on Frost Pllc You Should Know

Several current grads choose to begin with an accounting firm to build a structure for later job in the business sphere. Public accounting has the benefit of supplying a breadth of understanding, however, work-life balance can be a monster throughout tax period. Functioning for a bookkeeping firm will see even more change in hours.

In company bookkeeping, you are making the companyhelping construct its future. In public bookkeeping, you just get a glance into a firm however play no energetic role in where it's headed.

The accounting professional may produce additional records for unique purposes, such as determining the revenue for sale of a product, or the earnings created from a specific sales region. These are typically taken into consideration to be managerial reports, as opposed to the financial reports issued to outsiders. An example of a managerial record shows up in the adhering to exhibit, which shows a flash record that itemizes the essential functional and accounting problems of an organization.

C firms frequently just described as firms are public firms that are legitimately different from their proprietors in a manner that is various from any other type of firm (Frost PLLC). Whens it comes to LLCs and restricted obligation collaborations, owners are separate for the objectives of liabilities, but except earnings and losses

The Main Principles Of Frost Pllc

Of all, some firms can offer company stock in the stock market. When someone acquires stock in the company, they turn into one of the firm's proprietors (aka an investor). useful source Companies commonly have several proprietors. Companies also pay tax obligations in a different way than various my site other types of companies. For other service frameworks, the owner can treat the company revenue as personal income for earnings taxes.

A company, on the various other hand, have to pay taxes on its earnings before it can distribute them to the owners. It'll have to pay the 2020 business tax obligation price of 21% on those profits, leaving it with $395,000 after taxes.

Some firms, if they fulfill particular requirements, may select to run as S firms. This setup allows them to prevent double taxes. Instead of paying company tax obligations, the owners of the corporation pay taxes on the business's revenues with personal earnings tax obligations.

The Main Principles Of Frost Pllc

From high-income tax preparing firms to actual estate tax companies, whatever you are looking for, there is a specific audit firm for it. These companies over here do audits of companies, companies, small organizations, government entities, and individuals.

Much like the various other kinds of audit firms, audit companies can be broken down better in specialty companies. A few of these experts are referred to as forensic accounting professionals. Small niche-based companies like this are a great method to obtain one of the most highly trained accounting professionals for a particular work. Risk of interior regulating firms is made for one particular job.

Report this page